Whether you are a small business owner or a professional looking to systematize your accounting and bookkeeping activities, selecting the correct software is crucial. With its introduction in the market, QuickBooks became synonymous with small business accounting. But why do many people prefer it? Is it as good as they say? This exhaustive review takes you through everything about QuickBooks; from its features and user interface to its security and customer support.

What is QuickBooks?

Primarily, QuickBooks is one of the most flexible accounting software packages built by Intuit – a brand that rings large in the finance and accounting field. For instance, it can assist you in accepting payments from clients, managing your business expenses as well as helping you handle taxes. This tool makes bookkeeping less intimidating than ever before; thus even the least financially literate small business operator can benefit from it.

Key Features of QuickBooks

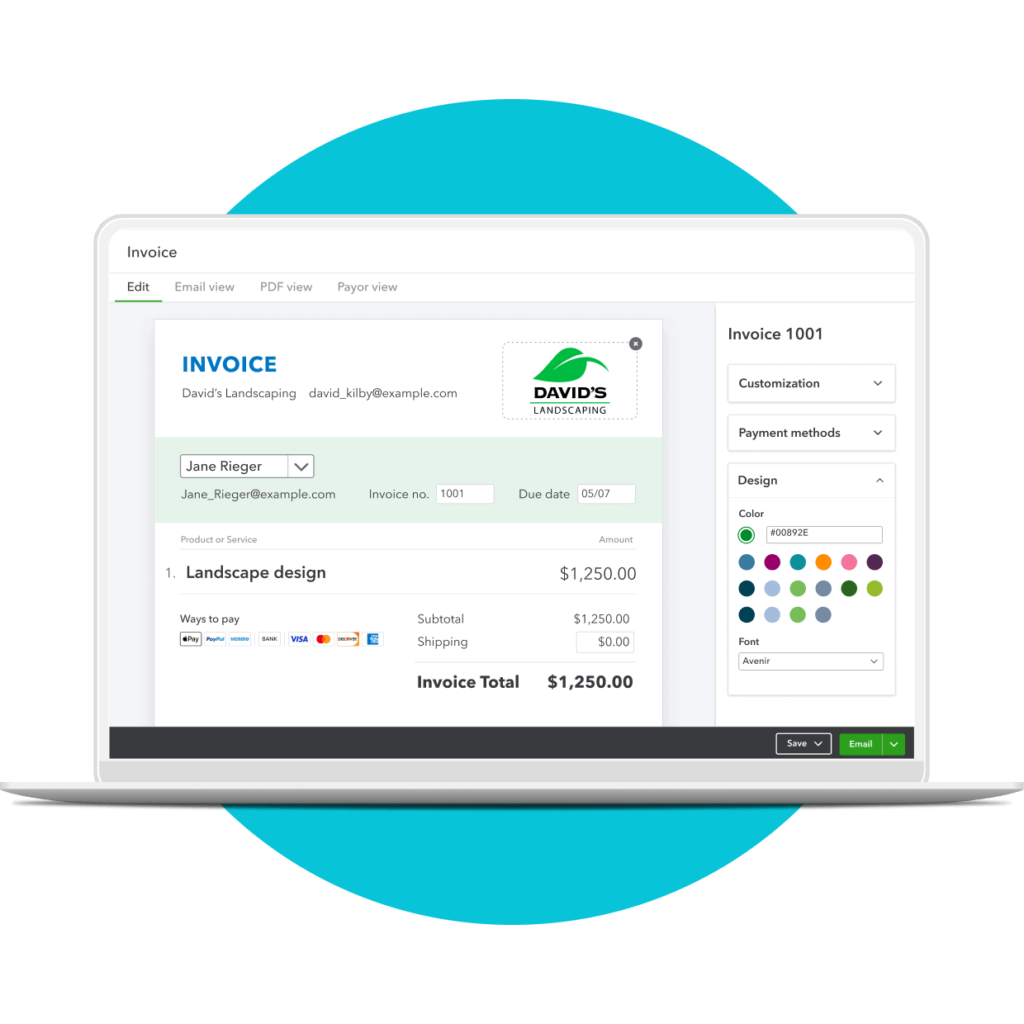

Comprehensive Invoicing

QuickBooks provides an advanced invoicing system whereby you can create invoices right within the software. Even though this feature supports various currencies, it also involves the automatic inclusion of sales tax rates on these invoices. You also have an opportunity to monitor new invoices sent out, or payment reminders sent via email and receive notifications when they have been viewed.

Expense Tracking

Under QuickBooks, businesses link their bank accounts and credit cards so that transactions get automatically imported therefrom for classification purposes. Streamlining processes saves time while increasing accuracy in tracking expenditures. There’s also an option of capturing receipts through the mobile app provided by Quickbooks which further simplifies expense management.

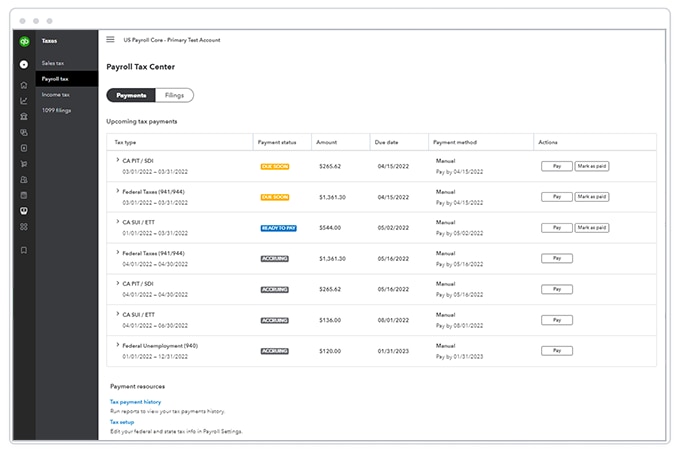

Payroll Processing

This makes payroll processing seamless by integrating employee payments into one platform. Additionally, this figure generates paychecks minus payroll taxes hence, saving time required to process them manually. Also incorporated are updated tax tables thus, ensuring compliance with current federal tax laws without requiring any additional downloads or installations.

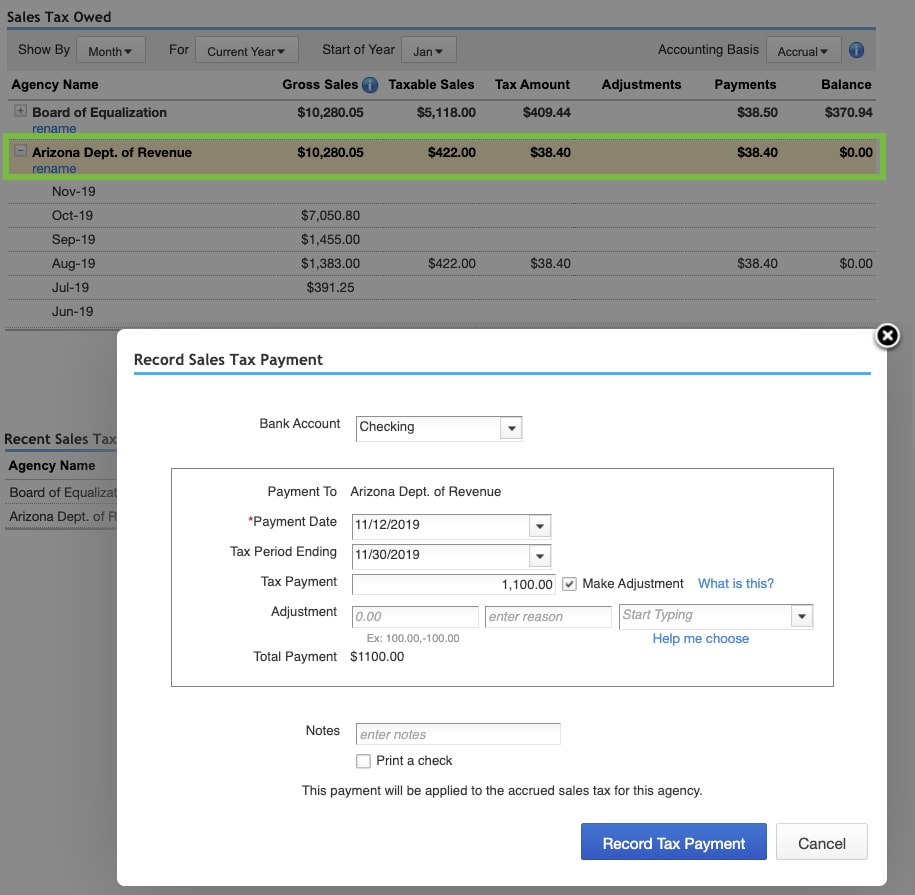

Tax Management

The program helps you prepare and file tax returns by keeping track of income and expenses throughout the year. It sorts out financial data in a way that is easy to access during tax time, whether it is for do-it-yourself or professional review. Moreover, QuickBooks comes with features that allow businesses to take advantage of tax deductions to avoid paying too much.

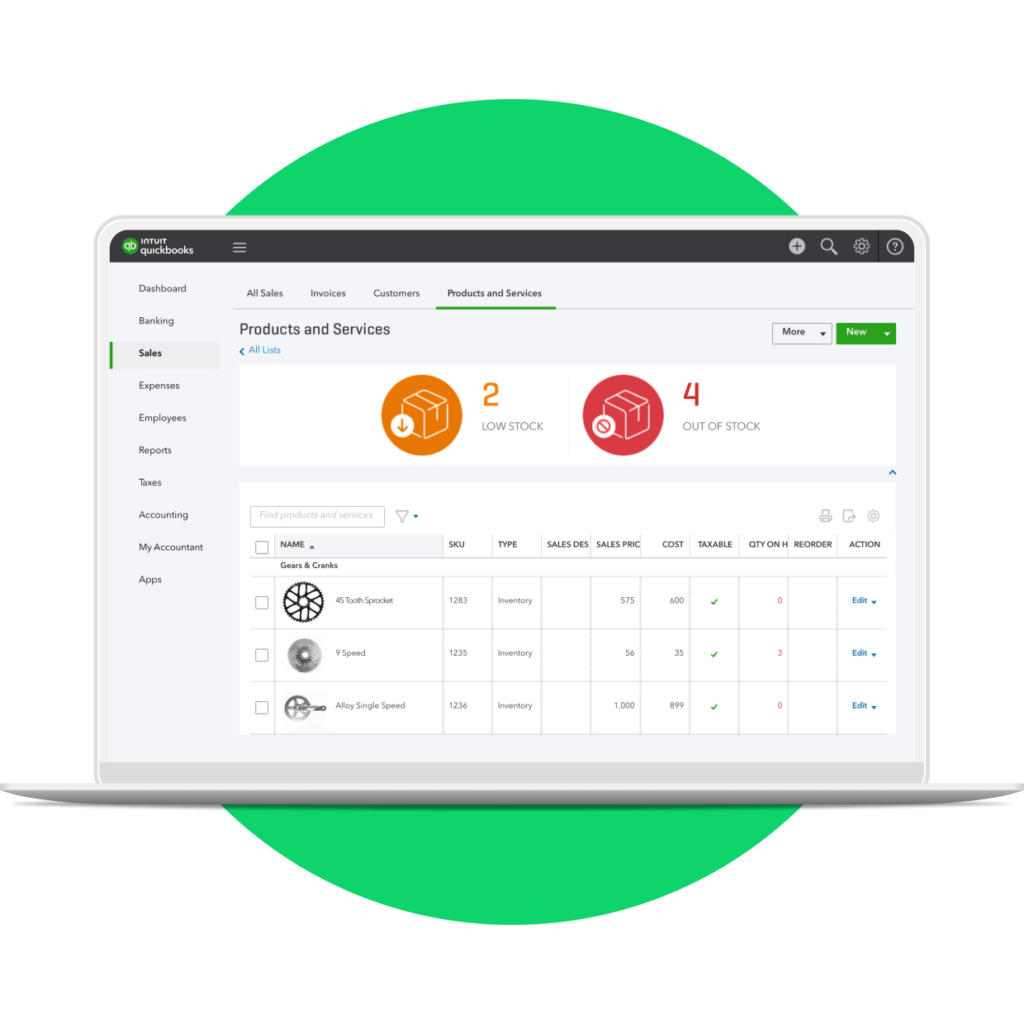

Inventory Management

QuickBooks offers an inventory management system designed specifically for you if your business is dealing with physical products. Inventory gets updated continuously as sales are made, ensuring that stock levels remain accurate. The feature also helps companies maintain optimum inventory levels thus, avoiding both overstocking and stockouts.

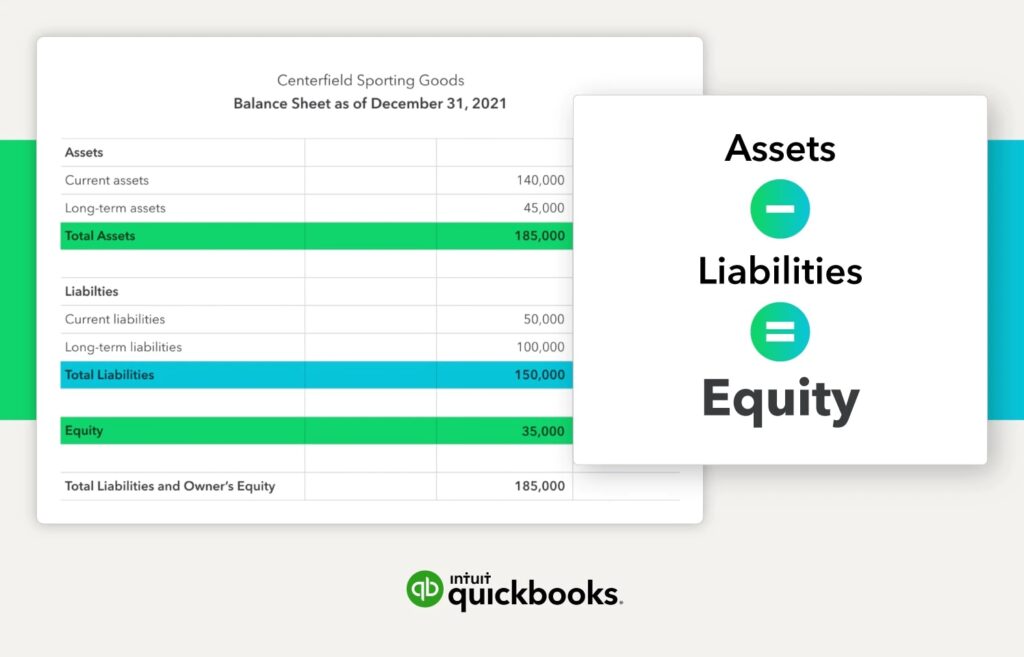

Financial Reporting

QuickBooks can generate many different types of financial reports including profit & loss statements (income statements), balance sheets and cash flow statements. Creating such reports only takes a few clicks and customization options are available if desired, offering deeper insights into the financial health of your business.

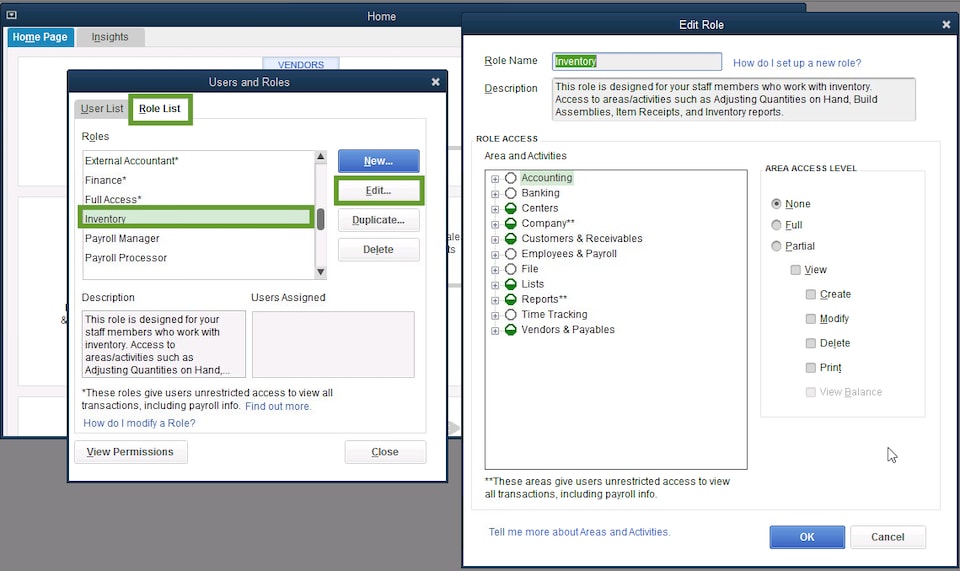

User Access Levels

To ensure internal control, QuickBooks permits owners of firms to establish several user access levels. As a result, every employee or accountant may have restricted access rights only, excluding certain parts which contain sensitive information about the company’s finances.

Cloud-Based Accessibility

Businesses can now easily manage accounts using QuickBooks’ online accounting platforms, regardless of their location or time. Apart from enhancing flexibility, this feature also promotes real-time updating and collaboration among team members.

Integration Capabilities

It integrates well with multiple third-party apps as well as business services, including CRM systems among others. This connectivity adds up to faster workflow in different areas of business operations that rely on each other thereby, making it easier for any data transfer process that might be required during such transitions.

Customer Support

QuickBooks’ customer support has a wide range of options available for you to choose from. it includes live chat, email, and phone. The company also offers many resources on the internet such as tutorials, forums, online reviews, and a comprehensive knowledge base which helps you make use of the software to the maximum.

What’s New in QuickBooks 2024?

AI-Powered Insights

QuickBooks provides one-of-a-kind AI-powered insights aimed at giving you predictive analytics on cash flow trends, inventory demands and financial trends. This innovation makes decision-making smarter by forecasting possible financial challenges or opportunities.

Improved Security Features

Quickbooks has greatly enhanced its security system hence, providing a more secure environment for crucial financial data. Multi-factor authentication (MFA) and advanced encryption protocols have been introduced to guarantee the safety of your monetary transactions.

Enhanced Customization

The most recent version of QuickBooks allows more ability to customize dashboards, reports, and invoices. You can now customize these items according to your organization’s brand image as well as the level of information required to create a personalized experience.

Simplified Payroll and HR

QuickBooks 2024 simplifies payroll/HR modules so that small businesses can easily onboard new hires, process payroll runs or handle HR tasks. QuickBooks does more automation than ever before, reducing manual workloads but increasing accuracy.

Expanded Integration Capabilities

Through integration with third-party apps or services, Quickbooks further expands its ecosystem. These include new e-commerce platforms such as advanced CRMs or tailored financial services thus, creating a more connected working environment where different sectors do business.

Mobile App Enhancements

The mobile app for QuickBooks now incorporates offline capabilities to provide better navigation features. With these improvements, you can track your finances effectively, wherever you may be. There is an efficient user-friendly interface designed specifically for this purpose.

Eco-Friendly Tax Filing Options

In line with its commitment to support environmental sustainability, QuickBooks has developed eco-friendly tax filing alternatives. This encompasses not only paperless filing but also electronic receipts thereby, promoting a more environmentally friendly approach to finances and taxation.

QuickBooks is a major update that focuses on giving small businesses the tools and insights needed for success in a competitive environment.

User Interface and Experience

Streamlined Navigation

For ease of use and efficiency, Quickbooks designed its user interface in such a way that it would be simple for you to find what you are looking for fast. The navigation menu has been made simpler and more intuitive so that you can easily switch between tasks like billing, reporting as well as payroll without going through complicated menus.

Customizable Dashboard

The dashboard is the epicentre of the QuickBooks experience, offering a holistic view of the company’s financial position at a glance. In most cases, QuickBooks allows you to customize your dashboard so that it shows you only what matters most; therefore, upcoming bills, outstanding invoices or recent transactions. This customization ensures that when you log into your accounts, all the crucial information will be displayed first.

Enhanced User Interaction

Quickbooks tries to boost user interaction through things like tooltips, walkthroughs as well as contextual help. These features are meant to help newbies familiarize themselves with the system while giving immediate assistance whenever experienced users are stuck on unfamiliar tasks. This proactive method lessens learning curves thus, improving output rates.

Unified Experience Across Devices

Realizing the demand for accessibility in modernity, QuickBooks provides a unified user experience on desktop computers, smartphones and tablets. This implies that regardless of where you access QuickBooks, you will find the same simple interface and functionality. Therefore, as a result of this consistency, you can seamlessly switch between gadgets without having to change your working styles.

Advanced Customization for Reports and Invoices

To cater to various business demands, QuickBooks offers advanced customization of reports and invoices. You have the authority to change these documents so that they match your business branding like logos, colours and fonts among others; in addition, you may decide which data to focus on. Thus, it makes it simpler for businesses when it comes to the presentation of professional and informative financial records meant for stakeholders.

Dynamic illustrations of information

In an attempt to make financial data more intuitive and easier to analyze, QuickBooks presents its reports through interactive charts and graphs. You can see detailed numbers by hovering over parts of the visuals, clicking through pie sections for a closer look at categories that interest you, or filtering results dynamically so only certain details show up. This hands-on approach to displaying data allows you not only to understand where you stand financially but also to act accordingly.

Toolbar for quick access

QuickBooks introduced a toolbar for quick access, allowing you to “pin” your most frequently used actions (like creating invoices or tracking expenses) so that they can be done with fewer clicks. This feature makes repetitive tasks faster by streamlining workflow and significantly increasing user productivity.

The user interface (UI) and user experience (UX) in QuickBooks have been designed with diversity in mind. The improvements made on navigation, customization, interactivity are not just fancier looks but smarter changes aimed at giving you power over your finances by using this software more effectively and efficiently.

Integration

Complete Integration with E-commerce Platforms

QuickBooks has dramatically improved its ability to integrate with major e-commerce platforms such as Shopify, WooCommerce, and Amazon Seller Central among others. With these integrations, comes automation where sales data can sync automatically together with inventory levels, purchase orders as well and customer info. This reduces manual entry errors while ensuring accuracy in financial reporting.

Advanced CRM System Integration

To streamline the customer relationship management process; Quickbooks connects itself with popular CRMs like Salesforce or Hubspot where organizations can update records automatically based on changes made elsewhere within the organization.

This enables you to track sales activities easily, besides being able to create customized financial reports derived from CRM data, all this without having to switch between two systems. This seamless flow saves both time & effort, leading to better-personalised customer engagement plus improved sales forecasting.

Financial Services & Payment Solutions

Another area where QuickBooks shines brightly is through integration with different financial service providers including PayPal, Square, Stripe etc. Businesses can process payments directly through QuickBooks and have transactions recorded automatically, as well as accounts reconciled within a few clicks. This enhances operational efficiency while granting companies greater control over payment processes.

Third-Party App Marketplace

The app marketplace of QuickBooks extends its online capabilities by integrating with multiple third-party applications designed for various business needs. From project management tools like Trello or Asana to time tracking apps such as Toggl; there are many ways you can customize your Quickbooks experience based on what works best for you.

Banking & Financial Institution Connectivity

Quickbooks has established direct links with hundreds of banks as well as other financial institutions which facilitate the automatic importing of credit card transactions among others. It, therefore, saves time since transactions get reconciled easily when all necessary information is readily accessible at any given moment. The security protocols used in data exchange between QBs & these institutions ensure the safety of both companies’ systems making it impossible for unauthorized persons to gain entry into sensitive areas without detection.

Payroll Service Integration

Integration between different payroll services (including QB Payroll) simplifies the otherwise complicated process by providing features like tax calculations, and year-end W-2 processing, besides allowing direct deposit etc.. With such an arrangement, businesses do not necessarily require external service providers but instead manage everything within one system thus, ensuring accuracy compliance laws about employee compensation, record-keeping, and taxation matters.

Custom Integration Capabilities

For those enterprises having unique requirements; QuickBooks enables custom integration capabilities via open API where developers create tailor-made integrations. This enables the connection between QBs with specialized software or systems thereby, affording flexibility and scalability.

These integrations are central to QuickBooks’ mission to offer a comprehensive, connected ecosystem for small to medium-sized businesses. By simplifying processes and automating exchanges of information between different systems, QuickBooks ensures that you can concentrate on your growth while managing your finances efficiently.

Improvements in Automation and Machine Learning

Automation and machine learning improvements have been introduced into QuickBooks to streamline financial management tasks, reduce human errors and create insights for businesses. These innovations are designed in such a way that they learn from your behavior and patterns hence, improving financial management with time.

Automated Expense Tracking

One of the main features is automated expense tracking which uses machine learning algorithms to accurately categorize expenses. This not only saves time but also ensures tracking correctly, which is important for budgeting and tax purposes.

Smart Invoice Processing

Another feature included in this software is smart invoice processing. It can intelligently scan invoices and then extract necessary data before inputting them into the right accounts payable fields section. This reduces manual entry requirements as well as lowers the chances of making mistakes thus, making invoicing faster & efficient.

Cash Flow Forecasting

There has been a significant enhancement made specifically in cash flow forecasting where historical financial data is analysed together with trends through machine learning to generate accurate personalized forecasts about cash flows. These can be used by enterprises when making decisions concerning investment expenses or growth strategy selection.

Predictive Analytics for Financial Health

QuickBooks also comes equipped with predictive analytics capabilities meant to evaluate a company’s financial health situation. It does so by scrutinizing patterns and trends noticed within various types of accounting figures. This helps management identify potential problems before they become difficult to solve while also suggesting areas for saving costs as well as revenue growth opportunities.

Machine Learning Enhanced Security

To add on, security aspects related to finance have not been left behind by QuickBooks. It has employed machine learning for such purposes. For instance, the software is capable of keeping records and familiarizing itself with usual user conduct. So, whenever, there are any suspicious activities or unauthorized attempts made towards accessing sensitive financial data, it can promptly send an alert thereby, safeguarding all necessary information.

These automation and machine learning capabilities of QuickBooks are intended to make financial management easier, more insightful and safer for businesses; through automating repetitive tasks. They also provide a deeper understanding of different aspects of finance thereby, enabling enterprises to save time by reducing errors as well as concentrate on strategic decisions leading to business growth.

Performance and Reliability

Improved Performance Leads to Efficiency

QuickBooks 2024 has been designed in such a way that its performance is much better than before, making it possible for firms to handle their financial duties within the shortest time possible. This means that with optimized codebases coupled with streamlined processes contained in this program; you will be able to load pages faster than they used to do previously, process data quickly and navigate across the platform smoothly.

Such improved performance becomes very useful, particularly, when dealing with large datasets where quick access to various parts of financial statements may be needed frequently during day-to-day operations. This reduces time spent on routine tasks such as entering transactions or reconciling accounts payable ledgers.

Reliable Uptime Accompanied by Accessibility

The reliability feature found in QuickBooks comes from its promise which states that there shall never be downtimes exceeding 0.1%. Therefore, organizations can always rely on having access to their financials whenever required without fearing unexpected failures.

With cloud-based nature also guarantees availability regardless of location, provided the internet connection remains stable throughout the session.

User-Friendly Interface

QuickBooks boasts a user-friendly interface that is intuitive and easy to navigate. The platform’s dashboard provides a comprehensive overview of the company’s financial health, allowing you to quickly access key information such as income, expenses, and cash flow. Moreover, QuickBooks offers customizable templates for invoices, reports, and other documents, enabling businesses to personalize their branding and communicate effectively with clients.

Scalability and Flexibility

Whether a business is just starting or has been operating for several years, QuickBooks offers flexible solutions that can scale with the company’s needs. The platform is equipped with features such as inventory management, payroll processing, and time tracking, which can be activated or deactivated depending on the business requirements. Additionally, QuickBooks supports multiple currencies and tax jurisdictions, making it suitable for businesses that operate internationally or across different regions.

Comprehensive Reporting

QuickBooks generates a wide range of reports that provide valuable insights into the company’s financial performance. You can generate profit and loss statements, balance sheets, cash flow statements, and many more reports with just a few clicks. These reports can be customized based on specific date ranges or filters to analyze different aspects of the business in detail. Furthermore, QuickBooks allows you to schedule automatic report generation and distribution via email.

Ongoing Modifications and Customer Assistance

Continuous software updates are made by QuickBooks to improve its efficiency and reliability. These updates include enhancements, new features, and security patches. The process is done seamlessly in the background so that businesses can always have the latest technology without interrupting their financial activities. Besides these technical advancements, QuickBooks has a wide range of customer support such as live chat support, phone support, and an extensive online knowledge base. This ensures that you get help whenever you need it.

With such performance improvements, QuickBooks becomes a top choice for businesses seeking to streamline their financial operations. Its efficiency orientation coupled with data safety measures and friendliness to users make it an invaluable resource for companies looking forward to enhancing their financial management practices while concentrating on growth.

Customization and Scalability

Adaptable Customization to Suit Each Business Need

QuickBooks appreciates that every business has unique requirements when it comes to financial management. Therefore, they provide many customization options which enable organizations to modify the software according to their specific needs.

For instance, you can create custom invoicing templates or personalized reports and dashboards among other things. This makes it easy for firms to align the functions of QuickBooks with their operational workflows. Such a level of customization not only improves user experience but also enhances the accuracy & relevance of financial information hence, enabling decision-making based on true operational reflections.

Ability To Meet Growing Needs With Flexibility

Scalability stands out as one major strength possessed by QuickBooks. As businesses develop, so do their demands. How they should handle money matters becomes more complex than before. In other words, QuickBooks grows alongside your enterprise thus, ensuring that all its tools & features remain capable of accommodating larger volumes of data together with sophisticated financial processes.

Advanced Features For Wider Requirements

QuickBooks has additional functions meant for organizations with advanced financial management needs that are more intricate during their growth. These include among others; advanced reporting and analytics, deeper inventory management features as well as enhanced automation of routine tasks.

With these kinds of abilities in place, it means that even when a business changes its form, QuickBooks will still be relied upon heavily by such an enterprise because it can easily manage a complex financial landscape.

Security Features

Advanced Encryption Standards

When storing or transmitting sensitive financial data, QuickBooks uses AES-256 alongside other advanced encryption algorithms to ensure maximum protection against unauthorized access. This level of encryption guarantees the confidentiality and integrity of business information thereby, giving enterprises peace of mind about security issues associated with their money matters.

Multi-Factor Authentication (MFA)

Another measure taken by QuickBooks towards enhancing security involves requiring multi-factor authentication from every user before granting them access to its systems. In other words, anyone trying to log into QuickBooks must first prove his/her identity through two or more factors such as passwords, followed by temporary codes sent via mobile phones thus, making sure that only authorized personnel can get into this financial management system

Continuous Monitoring and Threat Detection

QuickBooks employs continuous monitoring and threat detection technologies to identify and mitigate potential security threats in real-time. This proactive approach allows QuickBooks to respond quickly to any suspicious activity, reducing the risk of data breaches and ensuring that financial data remains secure.

Routine Security Audits

Regular security audits are conducted to evaluate and strengthen QuickBooks’ safety measures. These assessments help identify weaknesses as well as ensure compliance with current security standards and regulations. By continuously assessing and improving its protection framework, QuickBooks shows its dedication towards safeguarding user information.

Data Privacy Compliance

QuickBooks understands the importance of data privacy; therefore, it complies with major data protection laws such as GDPR or CCPA. This adherence proves that QuickBooks cares about your right to privacy, while responsibly handling your personal information.

Controls for User Access

Quickbooks enables organizations to set strict controls on employee access rights so that they only get exposed to financial figures relevant to their job descriptions. Such an approach reduces the chances of exposing sensitive records thereby, enhancing overall system security.

These advanced security features embraced by QuickBooks not only ensure data safety but also its management in line with the highest level of confidentiality standards. This holistic security model addresses several cyber threats making it a reliable platform for accounting purposes.

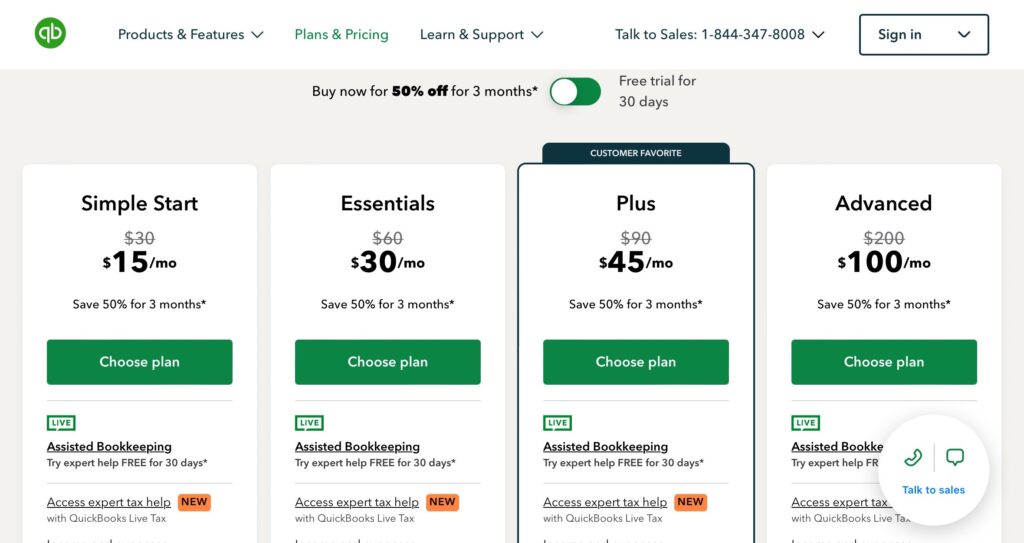

Pricing

QuickBooks has a wide array of pricing plans that can fit any business. Whether you’re an independent contractor or a large corporation, there is always an option for you. With Quickbooks, you can customize your services based on what will work best for managing finances. For all of the pricing plans online, there is a trial offered and at first, the discount looks nice which helps decide which one aligns most with your business strategy. Have a look:

Advantages Vs Disadvantages

Advantages

- It has been designed with simplicity in mind thus, making it easy even for those without any background knowledge about accounting software to use them effectively.

- There are many ways through which customization can be done on this software depending on one’s needs hence, suitable for different stages of growth enterprises may find themselves in over time.

- The use of high-level encryption ensures that all sensitive data is protected from being accessed by unauthorized persons or applications. For instance, QuickBooks uses multi-factor authentication, Continuous Monitoring and Threat Detection among others for safeguarding financial records.

- It can be integrated with other third-party applications hence, enhancing its overall functionality as well as versatility.

- With such a feature, it becomes easy to generate comprehensive reports about various transactions carried out within given periods.

- Has payroll processing ability, and inventory management among others so acting like an all-inclusive package for business financial management needs.

- There also exist versions which operate over cloud servers enabling real-time access from any point thus, facilitating remote working environments plus general flexibility.

Disadvantages

- At times depending on size, company subscription models may become costly especially, if additional features need to be purchased or new users are added to the system due to expansion reasons.

- Despite its user-friendly nature, having many options may overwhelm someone who has just started using it or running a small business entity that does not require too much accounting work input.

- Some complain about the inability to handle international standards and currencies well since most functionalities are designed for specific countries’ regulations only.

- In some cases, large quantities of information may slow down performance while trying to access detailed reports hence, slowing down operations speed.

- Areas with poor network coverage will suffer greatly in terms of the ability to connect internet services that facilitate smooth running. You should have access to reliable connection speeds throughout the entire session period required to accomplish set goals, tasks, and objectives.

- Some users have complained about poor service provision where customers have to wait for long hours before their issues are addressed. This has been attributed to a lack of enough staff to handle a huge number of calls received from different parts of the world wanting assistance at the same instance, which results in congestion leading to longer wait times per client.

- Also, difficulty in finding the right department or person to assist regarding specific problems encountered by users during the usage phase could be another reason why QuickBooks fails to deliver quality services support.

- Even though it integrates easily with many platforms, there are instances where setting up such integrations becomes a bit technical, requiring extra charges paid to achieve the desired outcome.

QuickBooks has many great features that can be useful in managing the finances of different types of businesses. However, every business needs to weigh the advantages and disadvantages and decide whether it fits their needs for growth and day-to-day operations.

Customer Support and Resources

QuickBooks provides a wide range of customer support and resources to help you navigate through its features, fix problems and maximize the software for your business needs. Here is an in-depth look at the available support and resources.

Vast Online Help & Documentation

QuickBooks has a vast online knowledge base that covers everything, from setting up your account to troubleshooting common errors, or questions about advanced features, and best practices. This resource is designed to help you find quick answers to common questions; as well as detailed guides for more complex tasks.

Community Support Forums

The QuickBooks Community Support Forums are a place where you can ask questions, share experiences, offer solutions or just talk with other people who use QuickBooks every day. It’s like having hundreds of experts right at your fingertips!

The forums are moderated by Intuit employees known as “community rock stars” who have extensive knowledge about QuickBooks products. They also receive additional training from Intuit specialists so they can provide even more expertise and assistance.

Training & Webinars

Whether you’re new to QuickBooks or an experienced user looking for tips on how to get the most out of it, there is a training session or webinar for you. QuickBooks offers beginner-level webinars that cover basic topics such as setting up accounts payable/receivable or invoicing; plus more advanced ones which explore specific features in-depth (e.g., inventory management). The idea behind these educational resources is not only to improve your understanding but also to enhance your experience.

Dedicated Customer Support

If you need immediate personalized attention because something isn’t working right – don’t worry! Just reach out directly via phone call/email/live chat with one of their experts who will be happy to assist you further based on their vast experience solving similar issues before now. Their availability hours may differ depending on location. However, they do provide priority support tiers for certain plans, giving this option an edge over others.

ProAdvisor Program

The QuickBooks ProAdvisor Program is designed for accounting professionals specializing in offering QuickBooks services. This program offers advanced training, certification exams as well as dedicated support resources. You can also find a pro advisor near you.

If you are an accountant or bookkeeper who has not joined the network yet, then this could be what your career needs most right now! These people know everything about QB so they can give better advice than anyone else could ever provide. Their knowledge level goes beyond theory alone; it’s backed by hands-on experience working with clients just like yourself.

On-Demand Video Tutorials

In addition to webinars and training sessions, QuickBooks has created a library of on-demand video tutorials that provide step-by-step instructions for different tasks within the software (e.g., creating invoices). These self-paced tutorials are perfect for visual learners or those looking to quickly get up-to-speed on specific areas they might have missed during earlier parts of their learning journey.

Accountant Help

If your business requires more advanced help with accounting principles or financial strategy, then consider collaborating with an external accountant via the QuickBooks Accountant’s Copy feature. This allows businesses to share certain parts of their file securely; thus making it possible for them to work closely together without needing access rights which could compromise security elsewhere within one’s organization. By sharing such critical data points between two knowledgeable parties – communication becomes easier while accuracy increases exponentially leading towards better decision making overall.

In conclusion, the customer support and resources provided by QuickBooks will go a long way in enhancing your business operations and financial management at large if properly utilized.

Alternatives To Quickbooks

Those looking for alternatives to QuickBooks should have a good understanding of the financial management software landscape. Here’s an in-depth look at some of the top competitors of QuickBooks, which is among the best accounting software for small and medium-sized enterprises (SMEs):

Xero

Xero is a cloud-based accounting software known for its real-time financial reporting and easy integration with over 800 apps. It is liked for its user-friendly dashboard and efficient reconciliation process. Features include automatic bank and credit card account feeds, invoicing, debt tracking, expense management and payroll processing. Xero also offers a project management tool that tracks time and job costing. Xero’s plans start from $12/month and go up to $65/month.

FreshBooks

Designed for small business owners and freelancers, FreshBooks provides an intuitive UI that supports invoicing, expense tracking, time tracking as well as project management. It stands out when it comes to customer service and the ability to extensively customize invoices. Additional features include automatic payment reminders, late fees and recurring invoices. FreshBooks also has a mobile app that allows users to manage finances on the go. FreshBooks pricing starts at $15 per month for the Basic Plan, $30 per month for the Plus Plan, and $65 per month for the Premium Plan.

Sage 50

Sage 50 targets simple accounting solutions required by small businesses. Invoicing features, expense tracking, and financial reporting are offered among others by this software package. One major benefit it has over other products mentioned so far is the choice between cloud-based or desktop solutions which gives more versatility depending on your specific needs as a business owner/manager/etc.. Sage supports Payroll processing together with credit card payments directly through their software. The plans follow a tiered structure from $10 per month and go up to $25 per month.

Wave

Wave is free accounting software which makes it particularly attractive for very small businesses/freelancers/sole proprietors. It includes an invoicing feature, accounting & receipt scanning without any cost involved, whatsoever. Wave makes money through additional paid financial services such as payment processing or payroll services which start at $20 per month plus $6 per employee in tax service states. How these are not mandatory if you don’t need them so there are no hidden fees etc., what-you-see-is-what-you-get type of deal.

Zoho Books

Zoho Books is part of a larger suite of Zoho applications. It provides comprehensive accounting solutions with automated workflows, custom invoices, expense tracking and inventory management capabilities among others. Zoho Books integrates well with other Zoho apps as well as third-party applications thus, making it suitable for businesses looking to manage multiple aspects of their business in one place. It offers a tiered pricing model starting from $15 per month, $40 per month, and $60 per month.

These QuickBooks alternatives offer different feature sets & pricing options that will satisfy varying types of businesses. When choosing an accounting software package, you should consider your specific financial management needs together with how the functionalities offered by each package can support your business operations best.

Final Word

The right financial management system can make or break a business. Therefore, it is imperative to choose wisely among viable options available at hand. Comparing QuickBooks against counterparts indicates that every solution brings forth some strengths matched specifically for certain types/sizes of organizations.

Nevertheless, QuickBooks remains unmatched when it comes to comprehensive all-inclusive accounting solutions, supported by extensive integration capabilities. Ultimately what should guide you is a careful evaluation of your enterprise needs vis-Ã -vis the different options available to select, one that will not only enhance operational efficiency but also contribute towards the attainment of overall business goals.

FAQs

Q: What is QuickBooks and who can use it?

A: QuickBooks is a popular accounting software package designed primarily for small businesses but can also be used by medium-sized enterprises. Its core features include expense tracking, and payroll management among others while allowing creation & sending invoices electronically etcetera.

Q: Can one employ QuickBooks when handling personal finances?

A: Though mainly tailored towards establishments, some individuals might find this tool useful even in tracking personal expenditure due to its strong cost control plus budgeting capabilities.

Q: Does QuickBooks have a free version?

A: QuickBooks does not have a permanently free version, but it does offer a trial period where you can use the features of the software for free.

Q: Can QuickBooks help with taxes?

A: Yes, QuickBooks can help to prepare taxes by tracking expenses, categorizing transactions and producing necessary financial reports.

Q: How does QuickBooks handle payroll?

A: QuickBooks has an integrated payroll service that calculates taxes automatically, files them for you, as well as pays employees.

Q: Can I use QuickBooks on my phone?

A: Yes, you can access your QuickBooks account from your mobile device. They have applications available for both iOS and Android that allow you to manage your finances while on the go.

Q: What kind of support do they offer if I need help with something in QuickBooks?

A: Within customer support, there are many different options you can choose from such as Help Centers, Forums, Direct Phone Support, Webinars or Training Resources.

Q; Do you think someone without any accounting background could figure out how to use QuickBooks easily?

A: Some people might find it difficult initially because of its extensive nature; however many individuals without prior knowledge about accounting systems have been able to grasp it over time thus, making this software manageable even for those who lack an accounting background.

Q: What are the dissimilarities between QuickBooks Online and QuickBooks Desktop?

A: QuickBooks Online is a cloud-based service that needs an internet connection and can be accessed in real time. On the other hand, QuickBooks Desktop is a conventional software which can be installed on computers with industry-specific features in mind.

Q: How secure is QuickBooks?

A: QuickBooks considers security as its topmost priority. Such measures include data encryption and multi-factor authentication to safeguard customer’s information.